Your Tax Dollars Info Guide

Your Tax Dollars Info Guide

Why Do Schools Need Property Tax Levies?

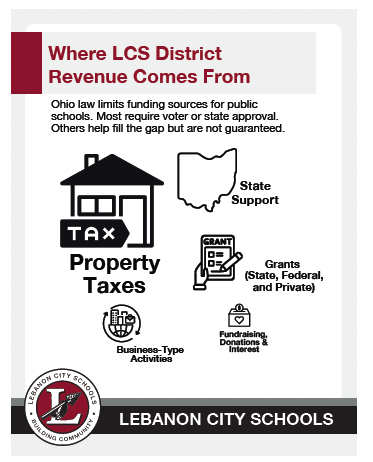

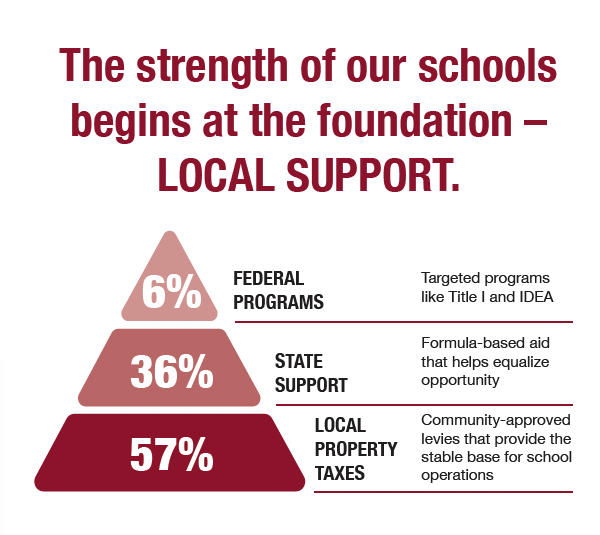

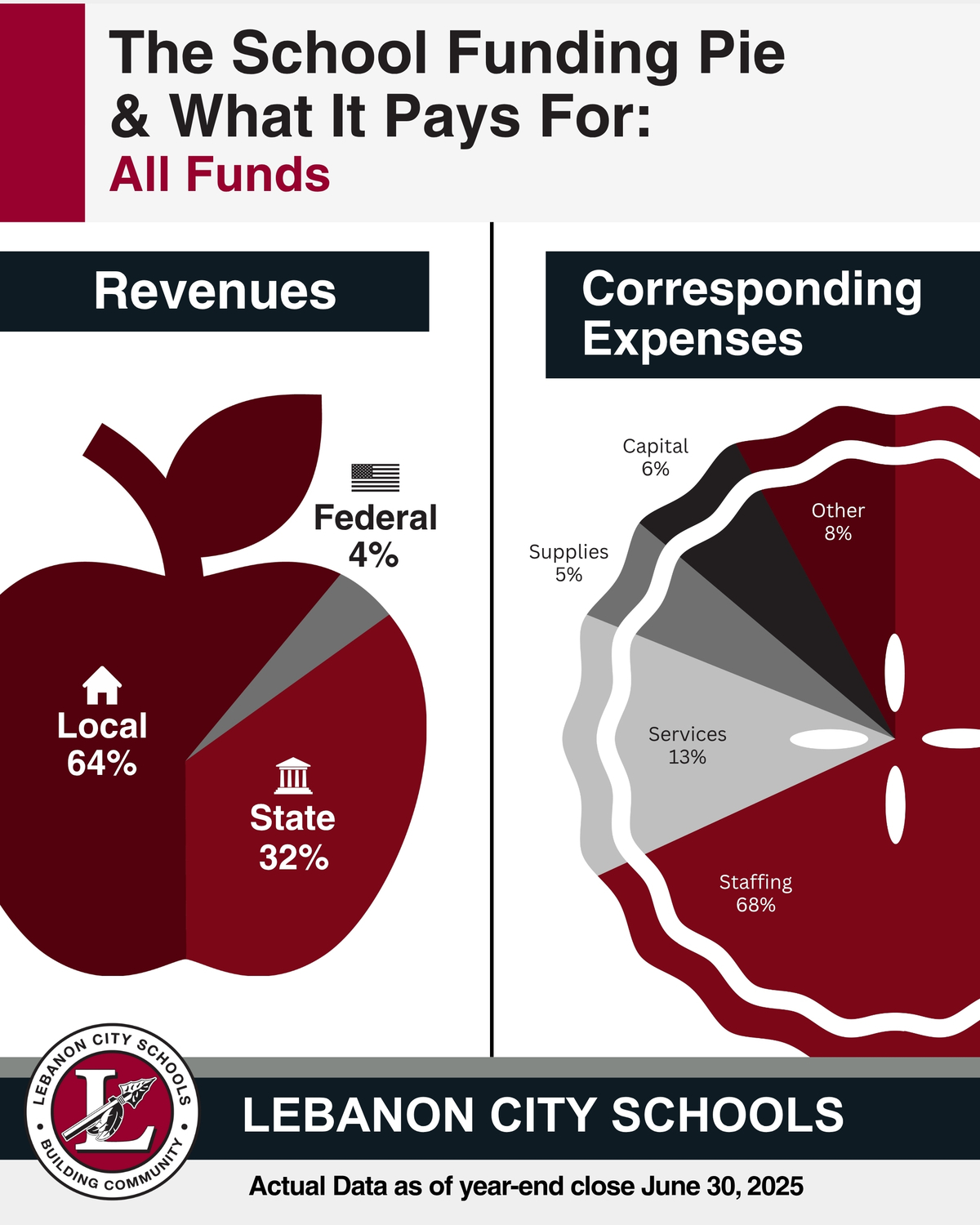

The Ohio Constitution, Article VI, Section 2 ensures that every child has the right to a quality public education. To uphold that constitutional right, the State established a funding system for schools supported by three main sources: local taxes, state aid, and federal programs.

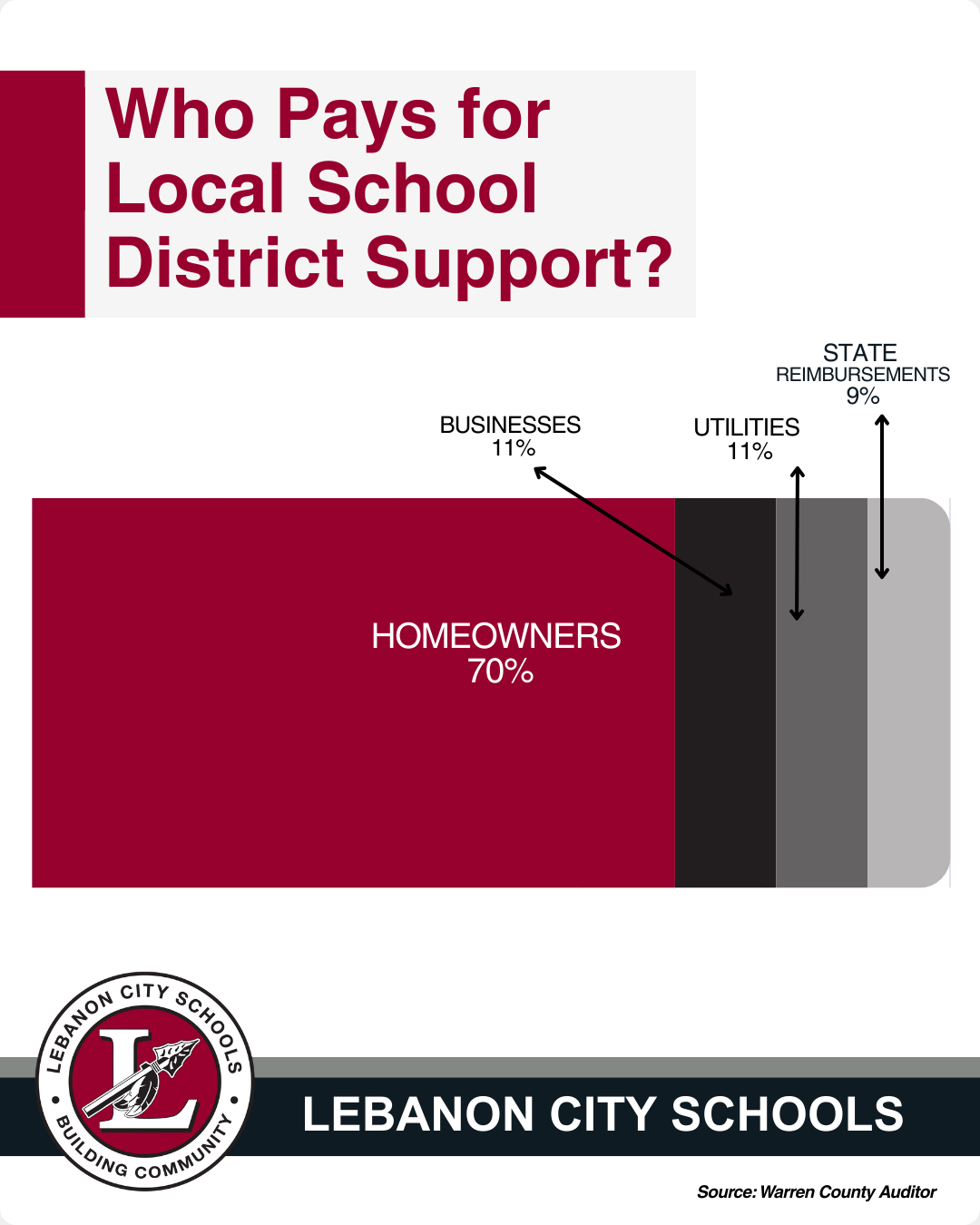

State aid and federal programs do not cover the full cost of education, so local taxpayers provide the funding needed to close the gap. In fact, local property taxes make up the largest and most stable portion of school funding. State funding fluctuates with budget approvals and economic cycles, whereas local property taxes remain relatively steady. With a foundation built on local property tax, Lebanon City Schools can plan ahead, maintain strong programs, and meet the needs of each student.

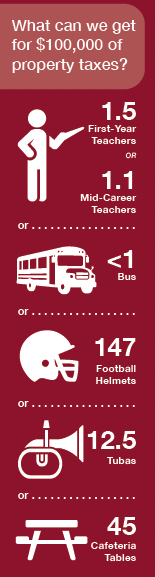

Funds generated through local property tax levies stay in Lebanon, directly supporting teachers/staff, classrooms, student programs, transportation, and safe, well-maintained facilities. In return, strong schools strengthen the community—boosting property values, drawing new families, and support a vibrant local economy.

Benefits of Property Tax:

- Revenues generated remain relatively stable (other revenues can fluctuate during economic downturns)

- Tax base stays consistent – houses and land do not “move”

- Local tax payers receive local benefits

“Our schools reflect the strength of our community, and every dollar invested in our schools tells a story of community support and shared purpose. Local tax dollars stay in Lebanon and sustain strong programs, safe schools, and bright futures for Lebanon’s students.” ~ Roy MacCutcheon, President of the Board of Education

School funding in Ohio is complicated, but we are committed to helping our community understand these concepts. Every public dollar we receive is used for the benefit of our students and supports our mission to Build a Reflective, Respectful, and Responsible Community. ~ Karen Ervin, Treasurer/CFO

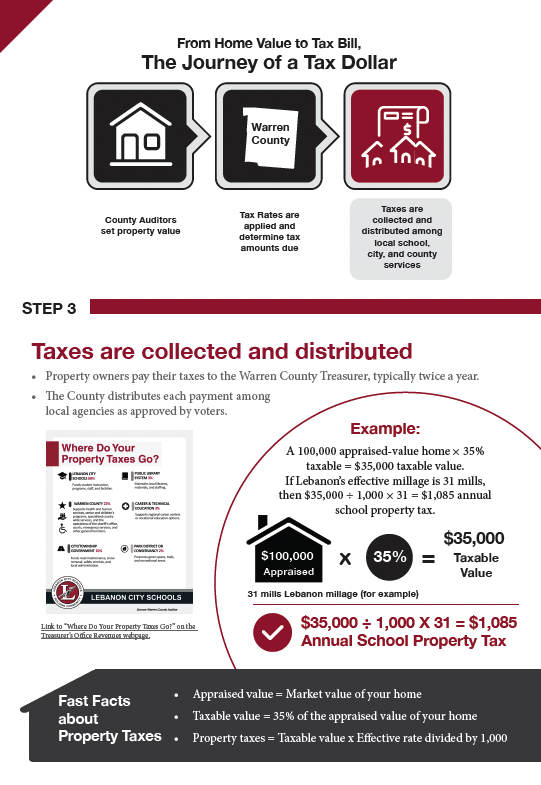

How Property Taxes Work (and Where Your Dollars Go)

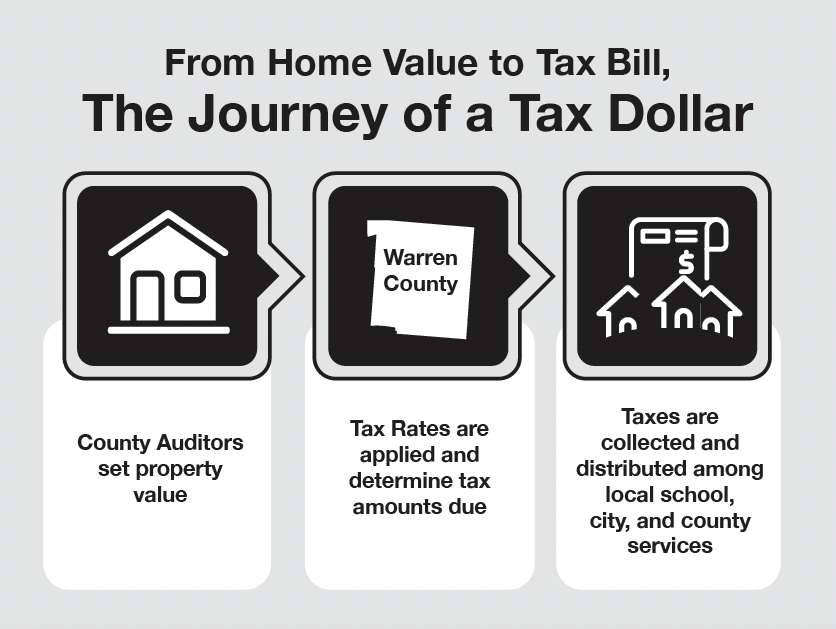

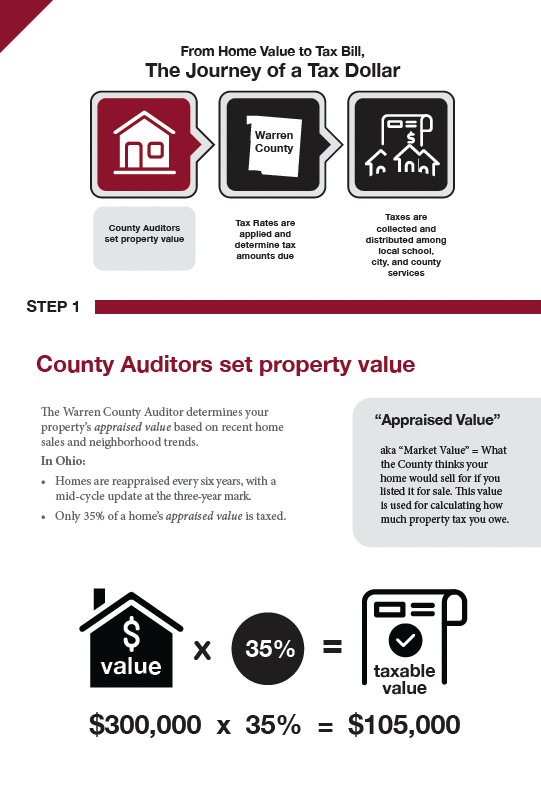

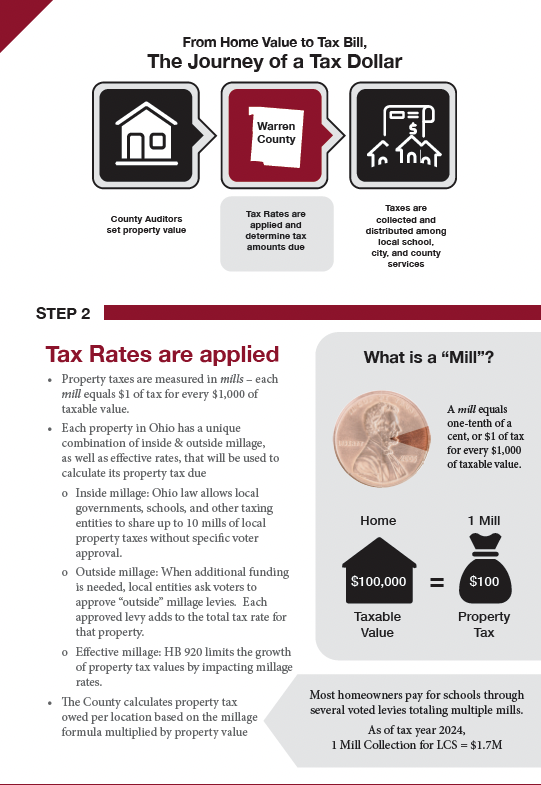

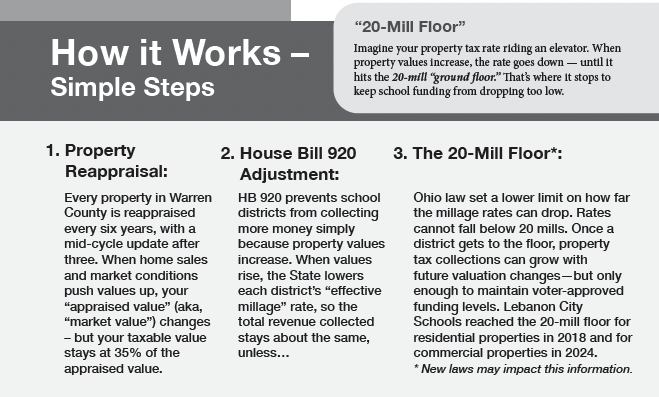

Property taxes are the main source of local school funding in Ohio — but the process that determines what you owe can feel complicated. Here is a simple look at how it all works, from your home’s value to how those dollars reach classrooms at Lebanon City Schools.

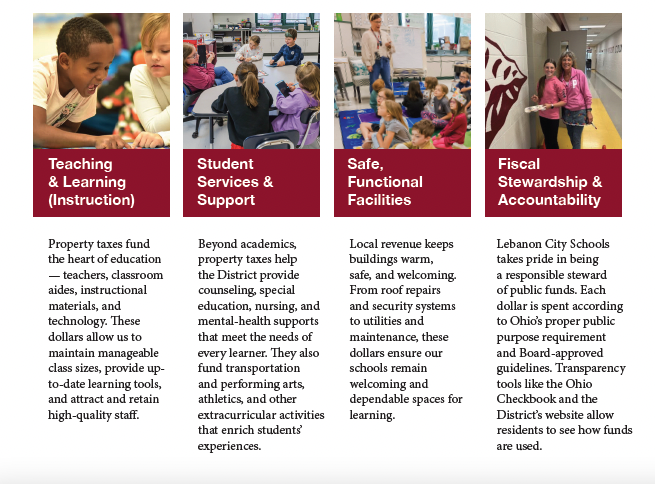

Your Tax Dollars at Work - Every $1 Matters

While Lebanon City Schools relies primarily on local property taxes, state and federal funds help supplement specific needs such as special education, student meals, and Title I programs. Together, these sources create the balanced funding model that keeps our district running.

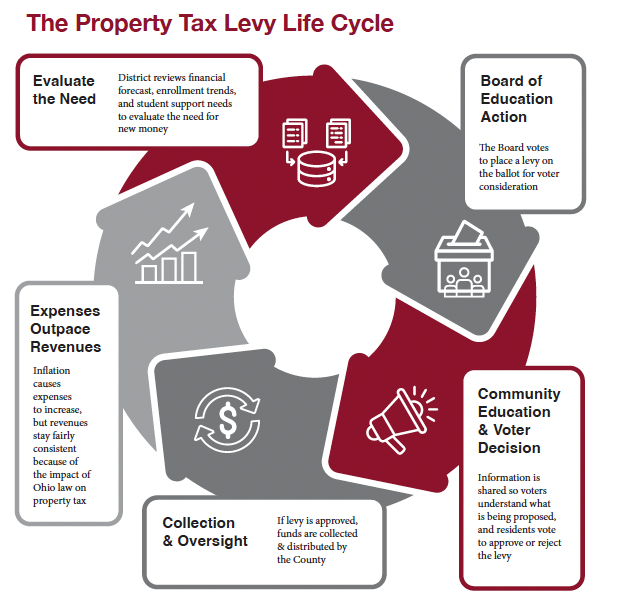

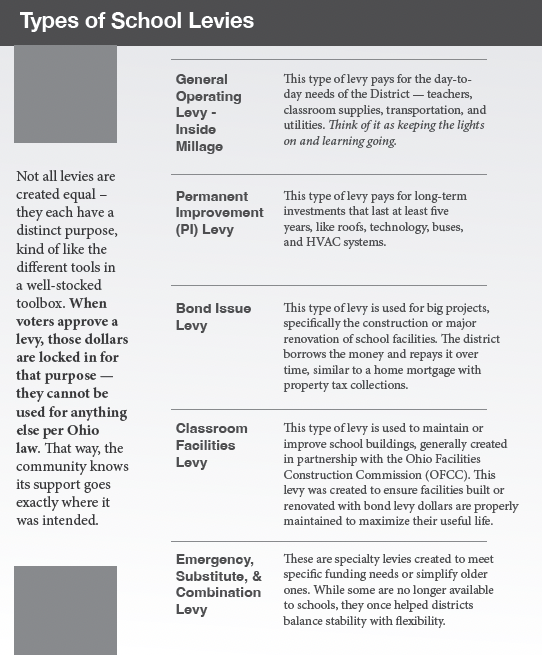

Understanding School Levies

Levies are not automatic. They are a local decision - approved by the community, for the community. In Ohio, schools cannot raise local property taxes without voter approval. When the cost to educate students increases beyond what current funding can cover, schools can ask voteres to support a new levy. Each levy proposal is carefully studied to balance student needs, community expectations, and fiscal responsibility.

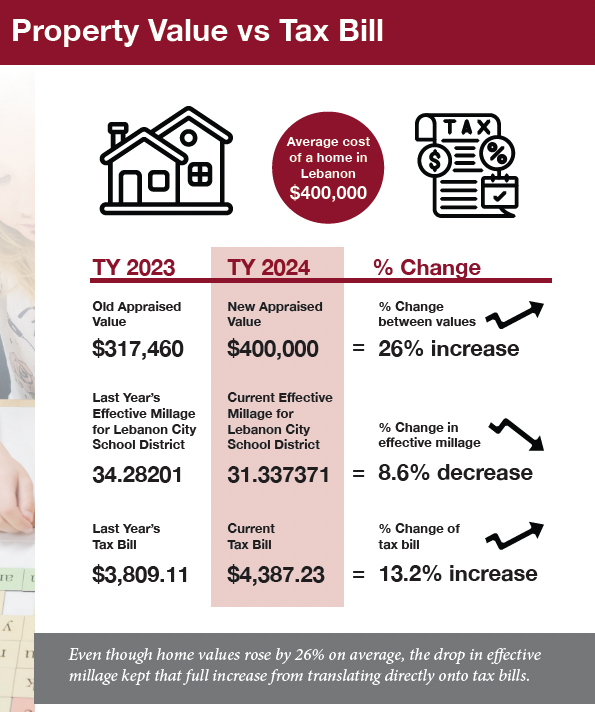

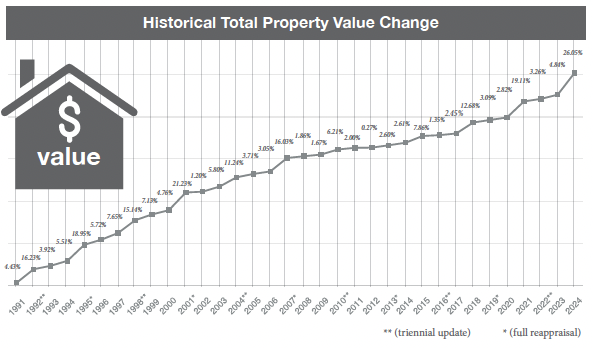

Why Schools Might Not Automatically Collect More When Your Home Values Rise

Today’s conversations about rising property taxes echo the same concerns Ohio lawmakers faced nearly fifty years ago. In the 1970’s, when inflation and home values were climbing quickly, legislators passed House Bill 920 to prevent property reappraisals from automatically creating higher tax bills. The goal was simple: protect taxpayers from sudden spikes in property value while keeping school funding stable.

Lebanon City Schools Current Property Tax Levies and What They Fund

Not all levies are created equal - they each have a distinct purpose, kind of like the different tools in a well-stocked tool box. When voters approve a levy, those dollars are locked in for that purpose, and cannot be used for anything else per Ohio law. That way, the community knows its support goes exactly where it was intended.